Money Transfers Made Simple

Move your money quickly and securely with our range of transfer options designed for convenience and reliability.

Transfer Options

Choose from our range of transfer methods to meet your specific needs.

Internal Transfers

Move money between your own Trust Paycon accounts instantly and with no fees. Perfect for managing your finances across checking, savings, and investment accounts.

Instant Transfers

Move money between your Trust Paycon accounts immediately, 24/7.

- No transfer fees

- Available 24/7

- Funds available immediately

Scheduled Transfers

Set up one-time or recurring transfers on your schedule.

- Daily, weekly, or monthly options

- Automate savings goals

- Flexible date scheduling

Sweep Transfers

Automated transfers based on account balance thresholds.

- Set minimum balance triggers

- Prevent overdrafts

- Maximize interest earnings

External Transfers

Send money to accounts at other financial institutions or to friends and family. Choose the method that best suits your needs for speed, cost, and security.

ACH Transfers

Standard electronic transfers to external accounts through the Automated Clearing House network.

Processing Time

1-3 business days

Transfer Fee

Free

Daily Limit

$10,000

Monthly Limit

$50,000

Best for: Regular transfers when timing isn't critical

Wire Transfers

Expedited transfers for time-sensitive or high-value transactions with immediate availability.

Processing Time

Same business day

Transfer Fee

$25 domestic, $45 international

Daily Limit

$50,000

Monthly Limit

$250,000

Best for: Urgent transactions or large amounts

Person-to-Person Transfers

Send money to friends and family using their email address or phone number via our secure network.

Processing Time

Minutes to 1 business day

Transfer Fee

Free

Daily Limit

$2,500

Monthly Limit

$10,000

Best for: Splitting bills, gifts, or reimbursements

International Transfers

Send money to over 200 countries worldwide with competitive exchange rates and tracking.

Processing Time

1-5 business days

Transfer Fee

Varies by destination

Daily Limit

$25,000

Monthly Limit

$100,000

Best for: Sending money to family abroad or international purchases

Scheduled Transfers

Take control of your finances by scheduling transfers in advance. Set up one-time or recurring transfers to automate your financial goals.

One-Time Transfers

Schedule a single transfer to occur on a future date, up to 365 days in advance.

Recurring Transfers

Set up automatic transfers on a schedule: weekly, bi-weekly, monthly, or quarterly.

Flexible Management

Edit or cancel your scheduled transfers at any time before processing through online banking.

How To Make a Transfer

Follow these simple steps to make a transfer using our online banking platform.

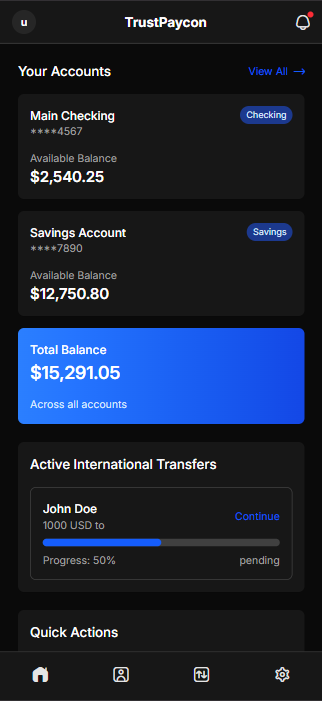

Log in to Online Banking

Access your account through our secure online banking portal or mobile app.

Select "Transfer Funds"

Navigate to the Transfers section from the main menu.

Choose Transfer Type

Select between internal, external, wire, or person-to-person transfers.

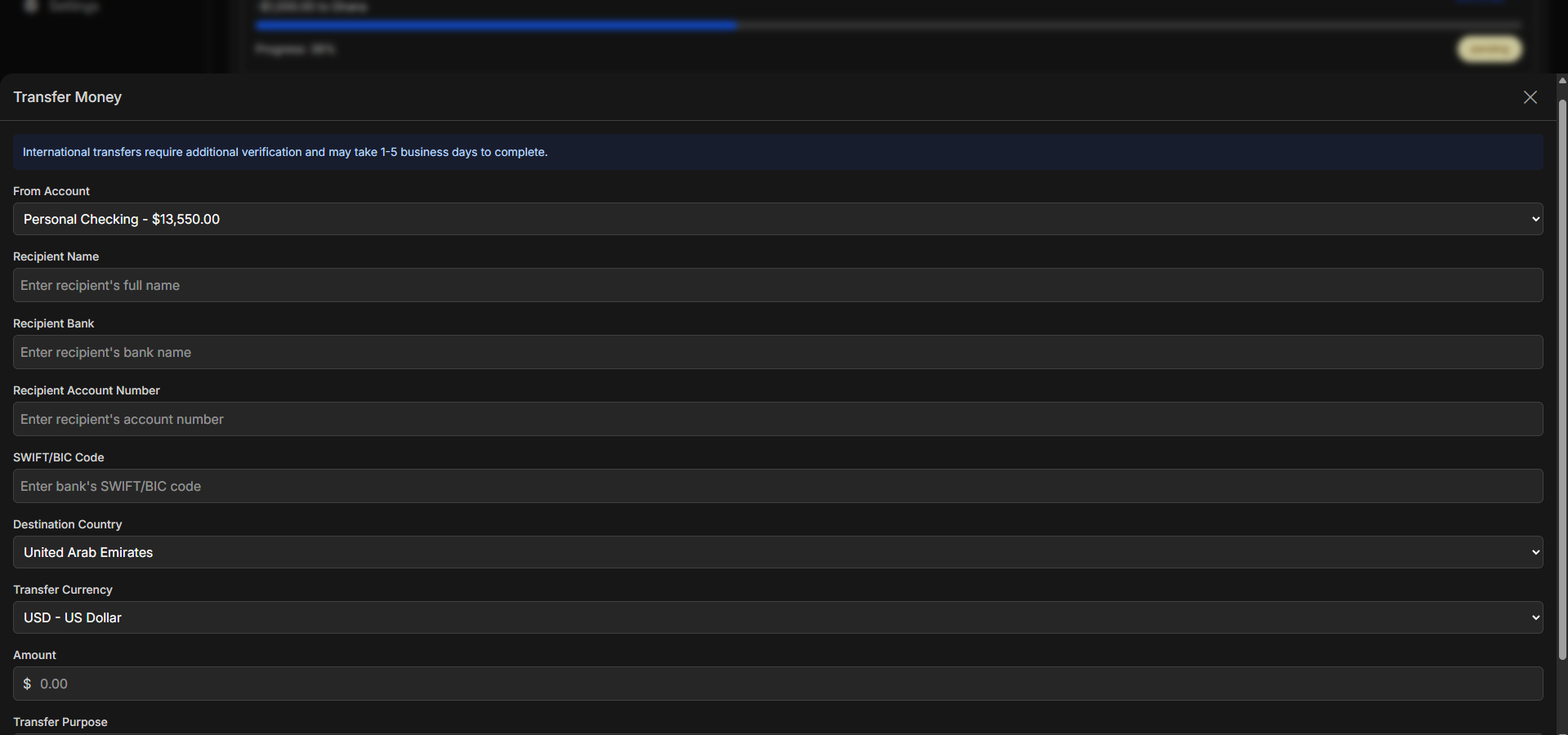

Enter Transfer Details

Specify the from/to accounts, amount, date, and add an optional memo.

Review and Confirm

Verify all transfer details and submit your transfer request.

Transfer Guides & FAQs

Find helpful resources and answers to common questions about transfers.

Transfer Guides

Setting Up External Accounts

Learn how to securely link your accounts at other financial institutions for easy transfers.

Read GuideInternational Wire Transfer Instructions

Step-by-step instructions for sending money internationally, including required codes and information.

Read GuideAutomating Your Savings

How to set up recurring transfers to achieve your savings goals automatically.

Read GuidePerson-to-Person Payment Tips

Best practices for securely sending money to friends and family using our P2P service.

Read GuideFrequently Asked Questions

What information do I need for an ACH transfer?

For ACH transfers, you'll need the recipient's account number, routing number, account type (checking or savings), and the name of their financial institution.

Are there limits on how much I can transfer?

Yes, transfer limits vary by transfer type and account status. Internal transfers typically have no limits, while external transfers have daily and monthly limits for security reasons.

Can I cancel a transfer after it's been submitted?

Internal and scheduled transfers can be canceled before processing. Wire transfers may be canceled if they haven't been processed yet, but may incur a cancellation fee.

How long do transfers take to process?

Internal transfers are instant. ACH transfers typically take 1-3 business days. Wire transfers are usually same-day but must be submitted before the cutoff time (typically 4 PM ET).

Is there a fee for transfers?

Internal transfers and standard ACH transfers are free. Wire transfers have fees ($25 domestic, $45 international). See our fee schedule for details.

Ready to make a transfer?

Log in to your Trust Paycon account to get started with quick, secure transfers.